Companies’ sustainability reputation during times of crisis shapes their ability to innovate over the long term.

As a business leader, you know that a good corporate reputation is one of your greatest assets. A positive public impression of your business has a host of benefits, from greater customer loyalty and brand differentiation to better relationships with stakeholders and even prices premiums.

During challenging times, such as the global financial crisis or the COVID-19 pandemic, you might be tempted to put reputation management on the back burner as you attend to other aspects of your company that have been thrown into chaos.

My recent study, co-authored with Matthew Grimes (University of Cambridge), suggests that you shouldn’t. In fact, it’s a good idea to pay more attention to your reputation in times of upheaval, not less. That’s especially true when it comes to your environmental, social and governance (ESG) practices. Our research found that during highly disruptive periods, public ESG criticism “imprints” on firms’ reputations, creating a long-lasting impression that shapes their future practices.

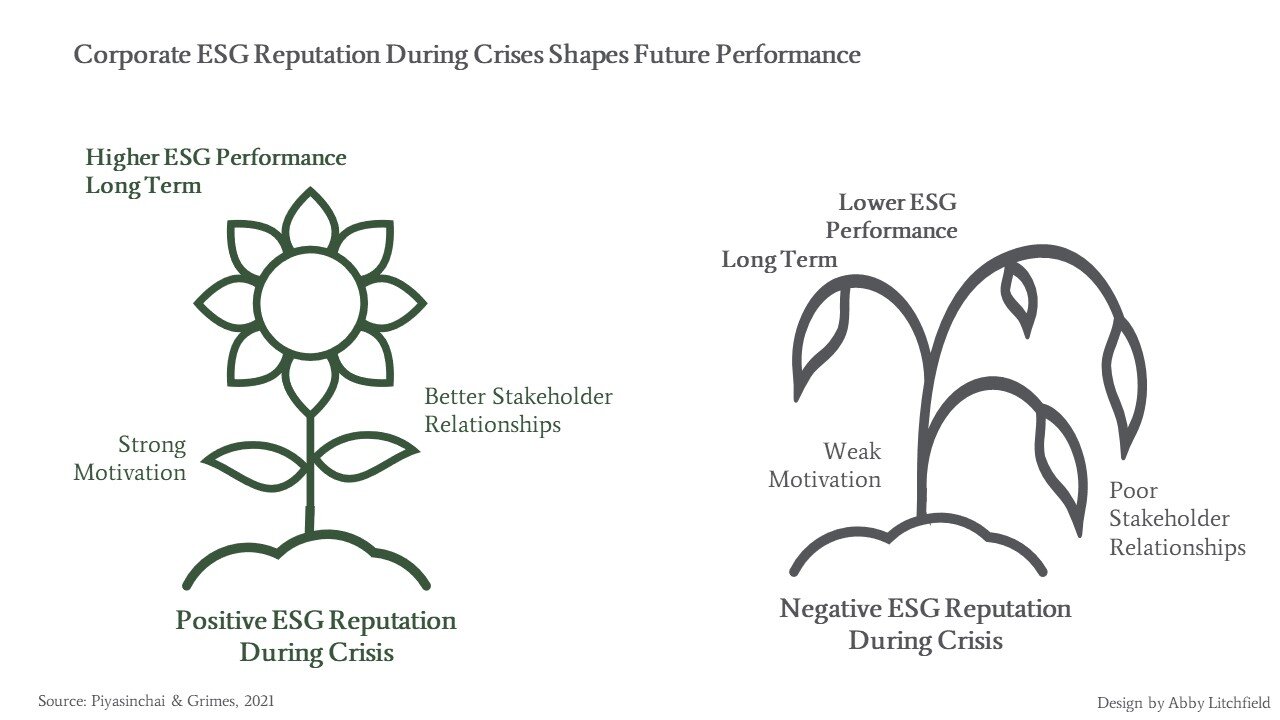

The good news: a positive ESG reputation during crisis periods will spiral upwards, in a virtuous cycle, in post-crisis years. A good public perception will lead to better relationships with stakeholders, allowing you to innovate even more good sustainability practices, which in turn lead to an even better reputation.

The bad news: Companies that face extensive criticism on ESG during times of crisis are likely to be caught in a vicious cycle. The damaged reputation limits their ability, and perhaps motivation, to improve sustainability practices post-crisis. The company’s reputation can fall ever lower.

Our study looked at the reputations of around 4,800 companies across 76 countries and 62 industries during the 2007-2009 financial crisis. Specifically, we assessed how much criticism these firms received in both traditional and social media regarding their ESG practices. We then looked at how this criticism shaped their sustainability strategies in the 10 years following the crisis.[1]

ESG reputation shapes company sustainability actions post-crisis

Crises are times when companies receive heightened attention – and criticism. For example, during the COVID pandemic, investors following ESG criteria looked closely to see how companies responded to employees, customers, and other stakeholders.

During the 2008-2009 financial crisis, two thirds of the companies in our study received little or no criticism on ESG issues (an average of less than 20 negative news stories per year). Happily, these companies generally showed learning and innovation in the sustainability arena, both during the crisis and beyond. Their ESG scores increased by approximately 4% in the two years post-crisis, and continued that positive trend.

For example: Starbucks became the target of labor disputes during the global financial crisis and also faced intense competition from McDonald’s espresso launch. But it turned the crisis into an opportunity to reform its business model. It put a focus on community involvement and introduced personalized customer initiatives, with enormous success.

However, 35% of companies received extensive public criticism (21-650 negative stories per year). They found that the damage to their reputations during the crisis had effects that were hard to undo. Reputational damage made it harder for them to gain new partners and suppliers. They also failed to benefit from their investments in sustainable practices because stakeholders saw their efforts as “greenwashing” and scrutinized their practices even more. After the crisis, these companies’ ESG performance fell by approximately 20% over the next 2 years, which led to more criticism.

For example: while ExxonMobil has long been criticized for its denial of climate change, such criticism became increasingly severe during the global crisis, with the launch of the Strike Out Exxon campaign by Greenpeace USA in 2008. Since then, the company has dramatically increased its CO2 emissions and reduced investments in clean energy. The company allegedly lost the motivation to change, believing that criticism would persist regardless of its actions.

Positively, we found that the vicious cycle caused by a reputation damaged during crisis can be reversed, if a company is determined and persistent. Our model predicts that a firm will need to spend years, even more than a decade, investing in ESG practices. Then, they can shift into a virtuous cycle, where its reputation supports its sustainability initiatives, and these initiatives enhance its reputation. It can be done, with passion to act and change existing ways of doing things.

For success, manage reality and perception

We know that media coverage doesn’t always reflect what companies are really doing. Our study found that crises can create an even wider gap between a company’s reputation and the reality of its actions. Some responsible firms in our study received extensive public criticism that they didn’t deserve. So companies should invest in both sustainability practices and reputation management, e.g. corporate communication and reporting, and building trusting relationship with key stakeholders.

Here are our recommendations for companies in times of crisis:

Keep focused on your company’s ESG reputation. Remember that your company’s actions during this period will “freeze” in the public’s mind, so that a damaged reputation can take years to mend.

Act ethically and prepare for scrutiny. Recognize that during a crisis, ESG actions receive more attention. Fix any trouble spots in your ESG practices and treat your employees and supply chain partners with dignity and respect. Note that criticism will likely focus on ESG issues related to the crisis. For example, during COVID, companies have received particular attention for governance and labour practices.

Reinforce communication. Showcase your ESG efforts during the crisis. Remember, they’re even more valued when times are tough.

Stay the course. If your company’s reputation has already suffered, don’t despair. Breaking a cycle is challenging but not impossible. You just need patience, persistence, and a genuine commitment to doing the right things.

I hope that our ongoing research will encourage companies to build trust and engagement, both inside the organizations and with external stakeholders. Those connections will enable them to be creative and innovative in navigating uncertainty, protecting their people, and building a just and sustainable society.

[1]A note on our research methods: In our analysis, we looked at companies which had similar ESG practices when the financial crisis began but then experienced different levels of criticism. This comparison allowed us to understand the effects of criticism and reputation, specifically, on companies’ future sustainability efforts.

To see the criticism companies received, we used the RepRisk database, which covers negative ESG news. To see companies’ ESG or sustainability practices, we used the MSCI “ESG management” score, which measures companies’ ESG policies, programs, and strategies.

About the Research

This post draws on Piyasinchai, N. and Grimes, M. “Reputational Spirals” working paper. This work won the Best Paper Award at 2020 IVEY/ARCS PhD Sustainability Academy. Our study is currently under journal review; contact the author for additional information.

About the Author

Nareuporn Piyasinchai is PhD Candidate in Strategy and International Business subject group, Cambridge Judge Business School, University of Cambridge. She holds an MPhil degree in Finance from the University of Cambridge and a BA in Economics from Chulalongkorn University. Prior to her PhD, she has had industry experience at the Bank of Thailand as well as at the management consulting firm Korn Ferry Hay Group in Bangkok, Thailand.

Nareuporn seeks to understand how and the extent to which businesses can take the lead in solving the world’s problems at scale and contribute towards a sustainable economy.

Add a Comment

This site uses User Verification plugin to reduce spam. See how your comment data is processed.This site uses User Verification plugin to reduce spam. See how your comment data is processed.