Discover six mechanisms by which corporate social responsibility drives a firm’s financial performance.

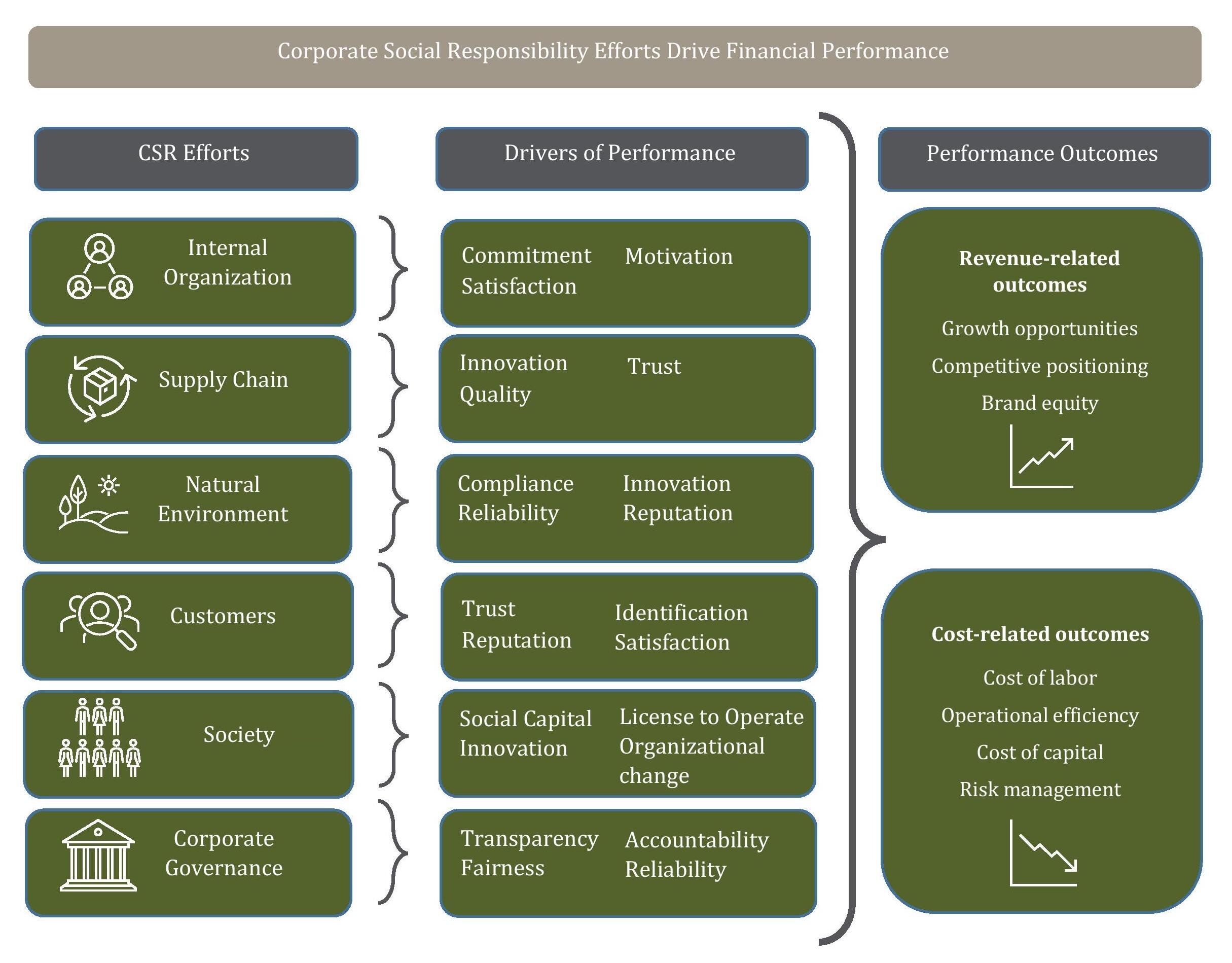

Managers can increase revenues and reduce costs when they understand the role of Corporate Social Performance (CSP) in driving Corporate Financial Performance (CFP). CSP is the outcome of company activities related to Corporate Social Responsibility (CSR).

Research on the relationship between CSP and CFP has produced some conflicting results, making the business case for CSR a very controversial area.

Now, a research team has identified the specific processes by which CSP impacts CFP. These show how CSR and CSP can benefit firms financially in multiple ways.

Looking at CSR’s Impact through 30 Years of Research

Previous academic research has focused on combined measures of CSP, treating it as an overall score. Researchers Francesco Perrini, Angeloantonio Russo, Antonio Tencati, and Clodia Vurro (all from Bocconi University) took a different approach. They looked at different aspects of CSP, and how each might affect firms’ finances: specifically, their ability to improve revenue and reduce costs.

The authors reviewed research from the past 30 years that examined the link between CSP and CFP, producing a multi-level framework.

Six Ways CSR Affects CFP

The authors found six primary processes, or “drivers,” by which CSR affects CSP. Each has clear lessons for managers.

Organizational drivers. These include organizational values and engagement in ethics-oriented practices and programs.

Lesson for managers: CSR enhances your human resource management. Firms with established reputations as positive places to work can attract talented employees. Employees at organizations with positive CSR practices and ethical values are more committed to the organization and have greater job satisfaction. Employee engagement can lead to both cost savings and growth opportunities.

Customer drivers. CSR can signal quality to consumers, leading to favourable views of the organization by consumers and enhance consumer loyalty.

Lesson for managers: Customers care about your CSR practices. Consumers are more committed, more satisfied, and identify strongly with organizations that have visible and well-established CSR practices. This effect can lead to multiple revenue opportunities.

Society drivers. Firms can accumulate social capital as a result of transparency, goodwill, and good citizenship.

Lesson for managers: CSR practices make your business appear less risky. Organizations engaged in CSR signal to stakeholders that they are committed to meeting stakeholder demands. Such organizations appear to potential lenders and investors as encompassing less risk. This perception can lead to revenue opportunities (as a result of positive positioning) and cost savings (as a result of a lower cost of capital).

Natural environment drivers. Pollution prevention and environmental strategies can lead to competitive advantage for firms.

Lesson for managers: Environmental performance influences your bottom-line. Improving environmental practices such as reducing pollution and improving waste management can lead to better financial performance through both increased revenues (e.g., enhanced brand equity) and lower costs (e.g., operational efficiencies).

Innovation drivers. Environmental goals can result in widespread changes in operations, fostering innovation.

Lesson for managers: CSR can drive innovation. Operational and cultural changes resulting from CSR can lead to growth opportunities through new product development, and to cost savings from production efficiencies.

Governance drivers. Just one example: Good disclosure practices can lead to greater visibility with stakeholders and financial partners.

Lesson for managers: CSR reporting practices strengthen your organization. The process of documenting and communicating CSR practices provides benefits to corporations, including the ability to formalize their position on CSR, identify organizational strengths and weaknesses, and manage stakeholder relationships and expectations.

There Are Still Mysteries in the CSP-CFP Relationship

While there’s evidence to support the researchers’ framework, additional research would be valuable. The researchers call for research to idenify the drivers most strongly related to positive financial outcomes. The external environment — for example, political and economic factors — may affect the impact of the different drivers. And, more needs to be discovered about how different drivers relate to each other.

This article was originally published in 2010 and updated in 2020 through conversation with the researchers.

Read the research: Perrini, F., Russo, A., Tencati, A., and Vurro, C. 2011. Deconstructing the relationship between Corporate Social and Financial Performance. Journal of Business Ethics, 102, 59-76.

Add a Comment

This site uses User Verification plugin to reduce spam. See how your comment data is processed.This site uses User Verification plugin to reduce spam. See how your comment data is processed.