To reduce your supply chain carbon emissions, partner with your Transportation and Logistics providers. Their broad lens can reveal opportunities.

Will Diebel is a researcher at Ivey Business School studying supply chain emissions.

Transportation and Logistics (T&L) is an essential part of most companies’ operations – and a big contributor to carbon emissions.

The sector moves materials and products between firms. It brings supplies to manufacturers and products to retailers or consumers. And it does this mostly with medium- and heavy-duty trucks.

Those trips produce a lot of emissions.

Carbon Emissions in the Trucking and Logistics Sector

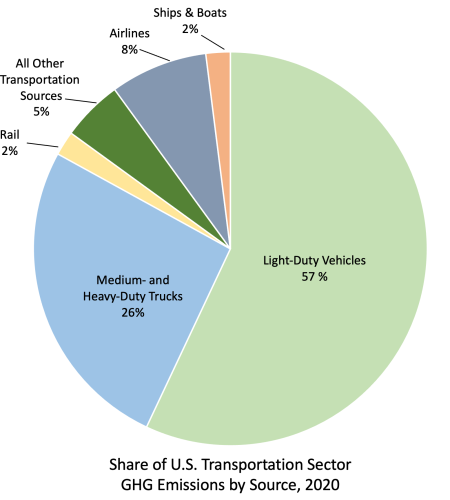

In 2020, a quarter of all US transportation sector greenhouse gas emissions came from medium- and heavy-duty trucks.1

That’s roughly 420 million metric tons of CO2 each year. And the US trend is similar to the global transportation emissions breakdown.

Companies can’t stop moving cargo. And yet, they also need to reduce their T&L emissions. T&L is among the top 10 emissions sources in most industries, according to research based on CDP reporting. Increasingly, companies are being held accountable for T&L emissions with the Greenhouse Gas Protocol , which includes any indirect emissions that occur across the corporate value chain. There’s regulatory and social pressure to act.

Experts Identify Opportunities for Emissions Reduction

Here’s the good news: New data provide new opportunities to reduce T&L emissions by increasing the sector’s efficiency.

I recently discussed these challenges and opportunities with two T&L experts, Ryan Gavin and Vishal Patell.

- Ryan Gavin is the Chief Growth Officer at Convoy, a company reducing inefficiency in trucking by digitally connecting shippers and carriers.

- Vishal Patell is Senior Vice President of Marketing, Strategy and Transformation at CHEP, a global leader in supply chain solutions operated through pooled pallets, crates and containers.

We spoke at the 2022 Reuters Transform Supply Chains Conference, where I moderated a panel with Gavin and Patell on “Mobilizing Your Supply Chain to Scale Decarbonization Efforts.”

Below, we share the recommendations that emerged.

How Companies Use Transportation and Logistics

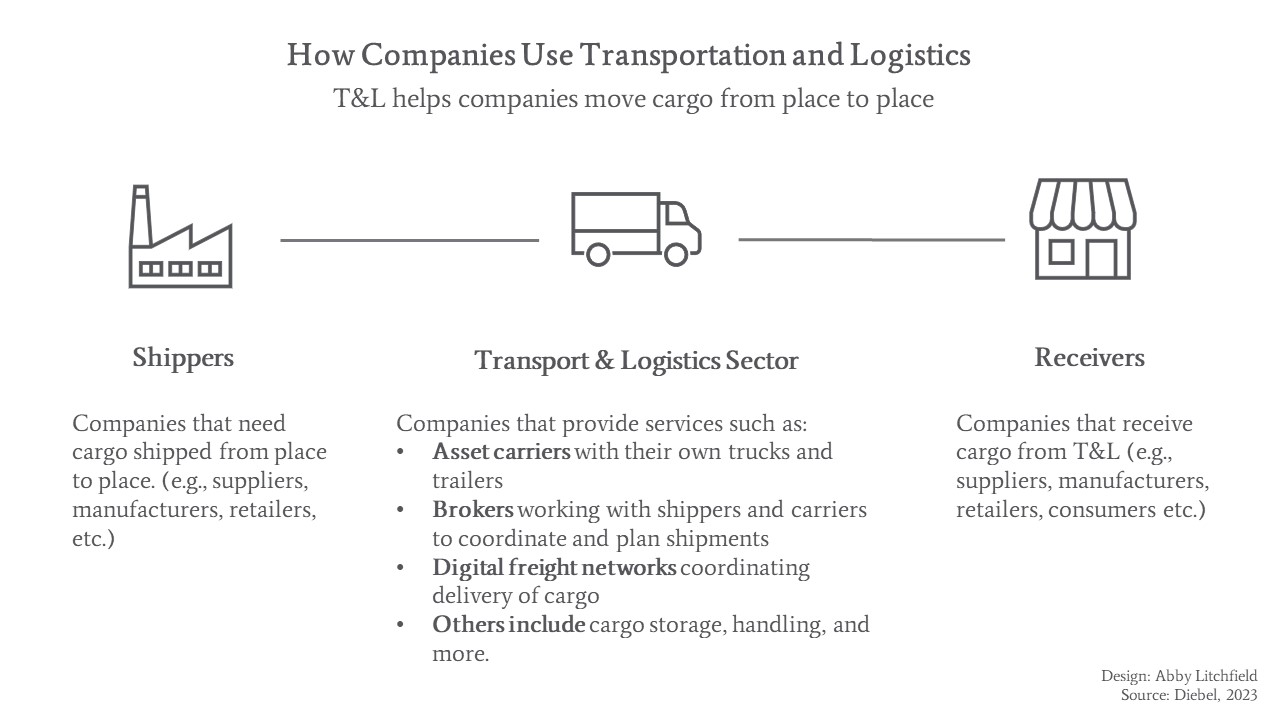

First, let’s get some more background on how T&L works. The figure shows the major players.

Shippers are the companies – whether suppliers, manufacturers, or retailers – that need cargo shipped from place to place. Many outsource all or some of these activities to specialized service providers: the T&L sector.

T&L service providers play several different roles. Many of them own trucks and employ their own drivers (“carriers”). Others support the movement of goods in other ways, like brokering shipments between shippers and carriers and providing materials and services such as shipping pallet rental and retrievals.

Gavin’s company, Convoy, and Patell’s company, CHEP, focus on delivering more sustainable freight transportation and pallet services, respectively. Because they work with multiple organizations – shippers and carriers – they have a broad viewpoint on the industry and its opportunities for decarbonization.

Target Inefficiency to Reduce Emissions

For companies interested in reducing emissions, “empty mile” inefficiencies should be the focus, according to Patell and Gavin.

Approximately 35% of all heavy truckload miles in the US are driven empty, according to research by Convoy. Trucks drop off deliveries but don’t restock for the next portion of their route, or they’re empty on the journey to pick up materials. Eliminating empty miles could thus reduce a significant portion of freight emissions.

Efficiency improvements are particularly important because other climate strategies for T&L aren’t yet in reach. For example, electrification would reduce fossil fuel usage – but it’s still at least several decades away from widespread diffusion.

Why Trucking and Logistics is Inefficient

What’s the explanation for inefficiency, and how could it change? Patell and Gavin point to issues with coordination, information, and motivation.

1. The T&L sector is fragmented. The US has one million T&L carriers, 90% of whom have six or fewer trucks, says Gavin. These small carriers traditionally move one shipment at a time. They “take a job, get someplace, wait, idle, wait to get unloaded, and then call and call and call for their next job,” explained Gavin. “Often they’ve got to drive home empty because they could never find a load to take back.”

2. Manufacturers and retailers make shipping decisions in isolation. A large company will have in-house transportation managers to manage relationships with carriers. But these managers don’t have visibility into other shippers’ freight, making it difficult to identify opportunities to reduce empty miles.

Companies may not even fully understand their own shipping processes. “We work with some of the nation’s largest shippers,” said Gavin. “It’s amazing oftentimes just how little visibility they have into what’s happening in facility operations.” Many of them still rely on manual processes and reporting, which reduces visibility into their operations.

3. T&L efficiency isn’t prioritized by companies. T&L emissions reductions have been a blind spot for high-level executives, according to research. Managers tend to see corporate sustainability as a cost center, Patell said – even though waste reduction has financial value.

For example: A carrier with three trucks could spend $34-$37,000 a year in fuel for empty miles. “They just can’t afford that,” said Gavin. The costs – or cost reductions – will extend to the shipping companies as well.

Data and Collaboration Can Reduce Inefficiency – and Emissions

The data revolution has reached the T&L sector.

T&L service providers like Convoy and CHEP are receiving huge quantities of data from the shippers, carriers, and receivers they work with. They use reports through apps, platforms/systems and RFID tags or sensors (e.g. on trailers and pallets) to have better visibility into their routes. As a result, they’re increasingly able to see where trucks and their cargo are going; where they’re stuck; and how they might be optimized.

To reduce empty miles, these data are used to:

- enhance operational transparency

- improve shipment coordination

- quantify and communicate the economic benefits of empty mile reduction

An individual company may be able to access some of these data points, but rarely has capacity for real-time analysis. But organizations at the forefront of T&L digitization may be eager to collaborate on sustainability initiatives: to work with shippers and carriers to find opportunities for efficiency.

Here’s an example: In 2022, CHEP used its view of customer shipping activities to facilitate partnerships with about 30 companies. These partnerships often identified overlapping routes between retailers and manufacturers to uncover new efficiencies.

These solutions ultimately reduced 2.5 million empty miles from the system – eliminating approximately 4,000 metric tons of CO2 emissions.

Convoy similarly overlays shippers’ routes, looking for patterns. Convoy uses machine learning to find connections and create efficient round trips, through a program called “Automated Reloads.” The vision is a “digital freight network,” automating truck matching, pricing, and scheduling.

4 Tips for Successful Collaborations in Transportation and Logistics

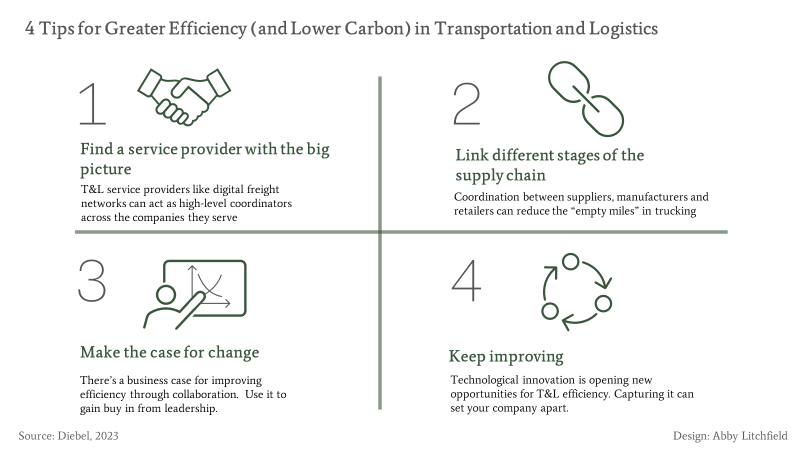

Successful collaborations to reduce carbon emissions require new data, tools, and commitment. “You need multiple shippers working together, collaborating, and you need some technology at its core,” said Gavin.

Here are some tips for success.

1. Find and exploit the high-level view. Digital freight networks and other T&L service providers are naturally positioned to act as high-level coordinators between the many firms they serve across industrial and retail sectors. Using digital technology, they can help integrate the efforts of otherwise fragmented routes and jobs. Some are also strongly committed to sustainability. Reach out and get their support.

2. Link different stages of the supply chain. A successful partnership could involve a manufacturer receiving supplies and using that same truck to deliver product to the retailer. From the retailer, empty pallets go back to the manufacturer. Patell calls this an “ideal circular move.”

3. Make the case for change. Businesses are often hesitant about sharing information with other companies and changing their existing patterns. “This is a human problem as much as it is technology,” said Gavin. Emphasizing the business case is particularly powerful.

Gavin describes steadily arguing for greater attention to T&L: “Managers will say, ‘Well this is how we do it and we’ve been doing it this way for 10, 15 years.’ To overcome that inertia, you’ve got to be able to show enough business value return that a manager can go to their boss and say, ‘Hey, I think we should change.’”

4. Keep looking for ways to improve. There’s a lot of room for innovation. “This space has really been void of a lot of technology-first solutions for many decades,” said Gavin. He and Patell are excited about opportunities for efficiencies through applications of machine learning and other approaches.

The future looks bright, and Gavin and Patell do see growing enthusiasm from companies. “I see shippers coming to us talking proactively about sustainability versus us bringing up proactively,” said Gavin. “And that is wildly encouraging for me.”

Acknowledgments

Special appreciation for thoughtful contributions, feedback, and editorial advice to: Ari Bixhorn and Chris Walker of Convoy, Kaleigh Williams, Rachel Barclay and colleagues at CHEP, as well as Abby Litchfield and Maya Fischhoff at NBS.

This content was inspired by a discussion at the Reuters Transform Supply Chains Event in October 2022. Catch the next Reuters Sustainable Business event here.

References

Blanco, C., Caro, F., & Corbett, C. J. (2016). The state of supply chain carbon footprinting: analysis of CDP disclosures by US firms. Journal of Cleaner Production, 135, 1189–1197. https://doi.org/10.1016/j.jclepro.2016.06.132

Ellram, L. M., Tate, W. L., & Saunders, L. W. (2022). A legitimacy theory perspective on Scope 3 freight transportation emissions. Journal of Business Logistics, 43(4), 472–498. https://doi.org/10.1111/jbl.12299

Terwiesch, C. (2019). Empirical Research in Operations Management: From Field Studies to Analyzing Digital Exhaust. Manufacturing & Service Operations Management, 21(4), 713–722.

Yan, T., Choi, T. Y., Kim, Y., & Yang, Y. (2015). A Theory of the Nexus Supplier: A Critical Supplier From A Network Perspective. Journal of Supply Chain Management, 51(1), 52–66.

Add a Comment

This site uses User Verification plugin to reduce spam. See how your comment data is processed.This site uses User Verification plugin to reduce spam. See how your comment data is processed.