The corporate sustainability reporting landscape can be overwhelming. This article describes key types of annual reports and advice for choosing among them.

“The Basics” provides essential knowledge about core business sustainability topics.

In 2021, I started writing an article on “the basics of sustainability reporting.” I was particularly focused on when, why, and how companies should report on sustainability issues.

Then I paused writing… because at that time, the complexity of the reporting system was mindboggling!

There were many types of reports, each targeted at a slightly different stakeholder group. And for each report type, organizations offered different — and sometimes competing — frameworks for guidance.

But what really stopped my article was all the change occurring. Global reporting organizations were beginning to consolidate under the new International Sustainability Standards Board (ISSB). This was a welcome attempt to streamline the reporting process for companies. Yet there was also heated debate about how this consolidation was happening.

The good news? It’s now 2023 and the landscape is beginning to settle — enough to write a useful primer on “the basics of corporate sustainability reporting.’

In this article, you will learn:

-

- Which types of corporate reports exist, including how they differ in content and audience

-

- Tips for choosing the right set of reports

-

- The main organizations offering frameworks to guide report creation

-

- The value that your organization can gain from reporting

I’m grateful to the experts whose wisdom forms the backbone of this article:

-

- Jonathon Hanks, Co-founder and Director of Incite. Jon guides companies in becoming more competitive by improving their societal value. He has worked extensively with several of the global standard-setting bodies on disclosure. (He also has the patience of a saint, answering my long stream of questions with patience and enthusiasm.)

-

- Xinwu He, Lecturer at Queens University Belfast. Xinwu researches how corporate reporting can improve organizational transparency, enhance accountability, facilitate long-term value creation, and contribute to achieving the SDGs.

Corporate Reporting Starts with Materiality

What kind of information does your company want to share with stakeholders? That’s what determines the reports you need.

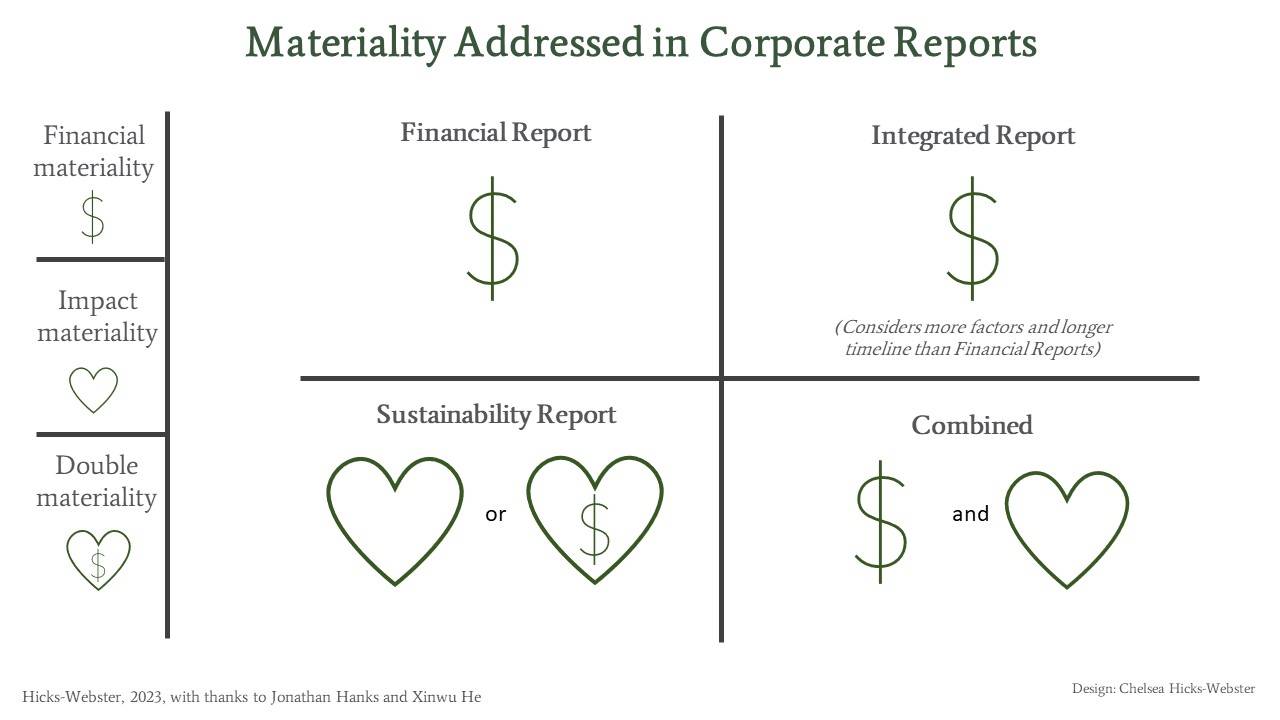

Two categories of information can be relevant or “material” for a company to report on:

-

-

Financial materiality: Financial materiality refers to factors that improve or erode a company’s ability to make money. The core audience for this information is investors.

-

Impact materiality: Impact materiality refers to how a company impacts people and the planet. Audiences for this information include non-profits, regulators, governments, sustainability-minded investors, employees, customers, suppliers, and local communities.

-

These impacts can be positive or negative. For example, a company might provide a living wage to workers, enabling them to develop stable lives – or it might keep them at subsistence wages, with more negative impacts. Impacts can also be direct or indirect – workers might be paid by a company directly, or be part of its supply chain.

You may also have heard of double materiality. That is when impact materiality and financial materiality, and the connections between them, are considered at the same time.

Issues can change categories, moving from ‘impact materiality’ to ‘financial materiality’ and vice versa. And some items relate to both categories. How workers are treated, for example, influences both employee well-being and workforce productivity.

Here’s a fun way to understand different types of materiality. If you were to compare corporate reporting to marriage, financial materiality would be talking about how your partner can meet your needs. Impact materiality is talking about how you can meet your partner’s needs. Double materiality is talking about how both people’s needs can be met at the same time.

3 Key Tips for Corporate Reporting

As I talked to Hanks and He, a few core pieces of advice emerged for those leading corporate reporting:

-

-

Include financial and impact materiality: Your company should report on its financial performance and its impact on the world – just like a healthy marriage requires thinking about both people’s needs.

-

Think long-term: Long-term thinking matters. If you only plan one year in advance, you’ll miss important risks and opportunities. For example, the impacts of global warming change little year-over-year, but will grow rapidly over decades. A short-term view means your company may not see future risks like, infrastructure damage from storms, or future opportunities, like pivoting to low-energy products.

-

Include multiple types of capital: Multiple kinds of “capital,” or sources of value, matter. Traditionally, companies reported only on their financial capital (money available) and manufactured capital (their ownership of machinery, buildings, etc.) But four other types of capital support value creation. These are intellectual, human, natural, and social/relationship capital. Integrated Reporting in particular takes this broader perspective.

-

5 Types of Corporate Reporting

So: Drawing on the different types of materiality, there are five broad types of reports that companies might produce.

-

-

Financial Reports

-

Integrated Reports

-

Sustainability Reports

-

Combined Reports

-

Subject-specific Reports (e.g. addressing human rights, climate change, corporate governance, tax disclosure, or other topics of stakeholder interest)

-

A company rarely produces just one of these reports. Rather, it produces a suite of reports to get the right information to the right people. Here’s an overview of each report type and how companies can combine them strategically.

1. Financial Report

In 1929, the New York Stock Exchange crashed, ultimately bottoming out at 89% below its peak value. The experience left investors wanting more transparent financial information on companies to avoid future losses.

That led to the establishment of the Securities and Exchange Commission in the US, and thebirth of the annual Financial Report, which is now a requirement for all publicly traded companies. This report focuses only on financial materiality, mostly over the short term. It helps investors and other organizations decide how to invest their money for quick growth.

Financial Reports are very long – often hundreds of pages. They describe a company’s financial performance over the previous year. They also predict the following year’s financial performance, by considering likely changes in financial and manufactured capitals.

Most countries require companies to follow the International Financial Reporting Standards (IFRS) for this type of reporting. (Canada and the United States are exceptions, with national standards to govern financial reporting.)

These reports are legally required, but inadequate for strategic decision-making.

2. Integrated Report

Investors are starting to realize that financial information alone cannot predict long-term financial performance. Financial Reports don’t give enough information about the potential impact of “non-financial” issues on the business’s activities — like its intellectual, human, natural, and social and relationship capital.

Integrated Reporting aims to address this gap. Integrated Reports, like Financial Reports, focus on financial materiality. But they improve on traditional Financial Reports in three important ways:

-

-

They are shorter, so easier for readers to understand (detailed financial statements can be provided separately.)

-

They describe “non-financial” issues (including sustainability issues) that present financial risk or opportunity, and how the company plans to respond.

-

They offer a longer-term perspective.

-

Integrated Reports target investors with longer-term financial goals. “The main aim of Integrated Report is to make the case to investors that your company is a good, long-term bet,” says Hanks. “[They show] your company’s potential to create long-term financial value.”

The broader lens and longer timeline of Integrated Reporting can also help companies to be more socially and environmentally responsible. Reports reveal strategic opportunities to boost profit by ‘doing good.’

For example: In South Africa, inequality and social unrest threaten business production. Recent protests and riots have caused significant financial costs for companies across many sectors in the country. Integrated Reporting can help South African companies find ways to improve their operational stability by reducing income inequality.

3. Sustainability Report

Not all issues have a financial business case. That’s where Sustainability Reporting comes in. Sustainability Reporting asks companies to consider all the ways they impact people and the planet (‘impact materiality’). The audience for these reports is broad, including non-profits, regulators, governments, institutional investors, sustainability-minded individual investors, employees, customers, suppliers, and local communities.

The health impacts of processed or sugary food show why Sustainability Reports are useful. These foods usually have high profit margins, which are good for business. But they harm people’s health, costing individuals and healthcare systems. These impacts are important, but won’t show up in an Integrated Report if they don’t impact the company’s bottom line.

Many companies use GRI’s Sustainability Reporting Standards to guide their sustainability reports. These standards take an impact materiality perspective.

There’s also an emerging trend to bring double materiality to Sustainability Reporting. Double materiality, remember, considers both impact materiality and financial materiality. In this case, the Sustainability Report would also identify how sustainability issues affect financial performance.

Both Hanks and He encourage companies to use the double materiality approach. “From my perspective, including double materiality makes the report better,” says reporting researcher He. “It describes the connectivity between sustainability and financial value creation.” The Draft European Sustainability Reporting Standards (ESRS) offer guidance for this approach.

A Sustainability Report can be valuable for companies. An Integrated Report can answer the needs of long-term and short-term investors, but Sustainability Reports directly address priorities of other important stakeholders.

4. Combined Report

Some companies include the content of their Financial Report and Sustainability Report into a single “Combined Report.” This differs from an Integrated Report because Integrated Reports explore the connections between financial and non-financial issues. Combined Reports simply display the data side by side, which can feel fragmented to read. It’s also a missed opportunity for strategic thinking. A separate Integrated Report and Sustainability Report can be a better way to reach priority audiences.

5. Subject-specific Reports

Ideally, a company would produce at least an Integrated Report and a Sustainability Report. Together, those reports ensure strategic consideration of both financial and impact materiality. Companies may also share a detailed set of financial statements, often omitted from the streamlined Integrated Reports.

Many companies also produce other, subject-specific reports. Additional reports could include employee compensation and equity, climate, governance, taxation and more.

Given the effort involved in reporting, why would a company choose to produce so many? Generally, companies are responding to pressure from specific audiences with these additional reports. They may repurpose some content from their core reports, and drill down deeper on a certain topic. Hanks notes that there is a huge drive for companies to separately report on climate change, following the Taskforce on Climate-related Financial Disclosure recommendations.

Kumba Iron Ore’s reports offer a good example of how an Integrated Report, Sustainability Report, and Climate Change report offer progressively deeper analysis of the same topic.

Importance of Corporate Reporting

Reporting can feel like a burden. But good reports – and the reporting processes –- will have strategic benefits for your company.

Hanks and He recommend that companies at least:

-

- Report on both financial and impact materiality – how will your business make money and how does it impact people and the planet?

-

- Consider the interconnections between these things over the long-term.

As we’ve detailed, an Integrated Report can broaden how companies and investors think about financial materiality, and help companies and investors maximize long-term earnings.

Integrated Reports are intentionally short. A Sustainability Report – preferably one that includes double materiality – is a valuable addition because it offers deeper analysis of the interconnections between the company, its community, and the environment.

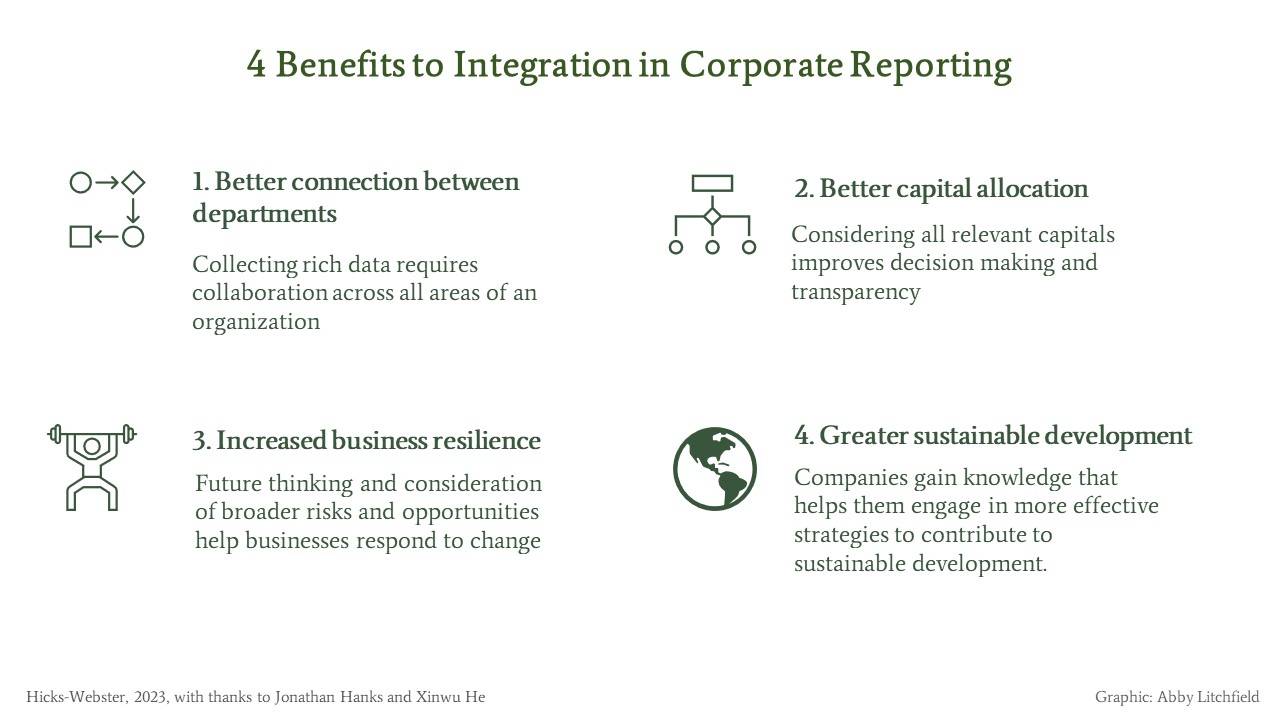

When done well, the big picture thinking enabled through an Integrated Report and a Sustainability Report can result in:

-

- Better communication and collaboration between departments: Collecting the rich data neededbuilds communication throughout an organization, from finance, to human resources, to operations. Everyone’s forced out of silos and into collaboration.

-

- Better capital allocation: More deliberate stewardship of all capital types improves decision-making processes and transparency.

-

- Increased business resilience: Future thinking and consideration of broader risks and opportunities help businesses respond to change.

-

- Greater sustainable development: Companies gain knowledge from the reporting process that helps them engage in more effective strategies to contribute to sustainable development.

Change Continues – But Reporting Goals Are Clear

Change is still afoot in the world of reporting standards. For example, the IFRS is creating a single, global standard for Integrated Reporting. They are consolidating previously independent standards and frameworks, like CDP, the Climate Disclosure Standards Board (CDSB), International Integrated Reporting Council, and the Sustainability Accounting Standards Board (SASB). IFRS will continue to refine its standards.

But there IS getting to be more clarity in the world of sustainability reporting. As I’ve outlined in this article, there’s growing consensus that companies should consider, plan for, and report on long-term financial and impact materiality, and ideally explore the connections between them. I hope these tips help your company use information as a tool to navigate to sustainable development.

What Do You Think?

Corporate reporting takes a lot of resources. How does your company ensure it gets the most value of its reporting processes?

Share your experiences in the comment section below.

About the Series

“The Basics” provides essential knowledge about core business sustainability topics. All articles are written or reviewed by an expert in the field. The Network for Business Sustainability builds these articles for business leaders thinking ahead.

Add a Comment

This site uses User Verification plugin to reduce spam. See how your comment data is processed.This site uses User Verification plugin to reduce spam. See how your comment data is processed.